In line with the Basic Policy on Corporate Governance, MC has established a remuneration package for Directors and Audit & Supervisory Board Members to ensure a sustainable increase in corporate value, and to ensure that their respective roles are fulfilled properly according to business execution and management supervision functions. The basic approaches behind the package are as follows.

The Governance, Nomination & Compensation Committee deliberates and the Board of Directors decides the policy for setting Directors’ remuneration and the remuneration amount (actual payment amount).

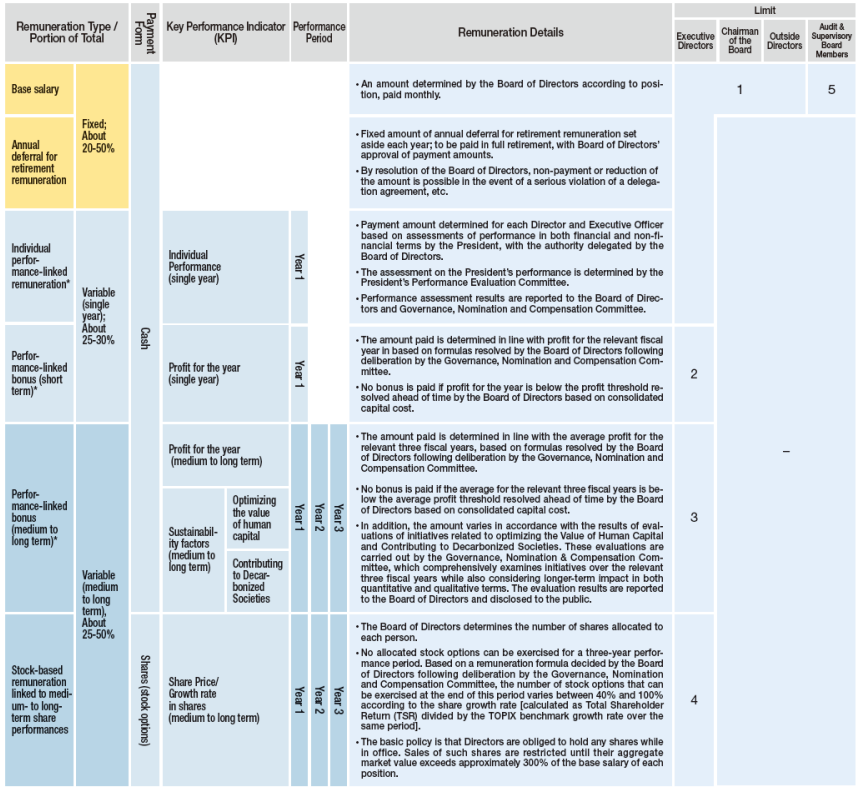

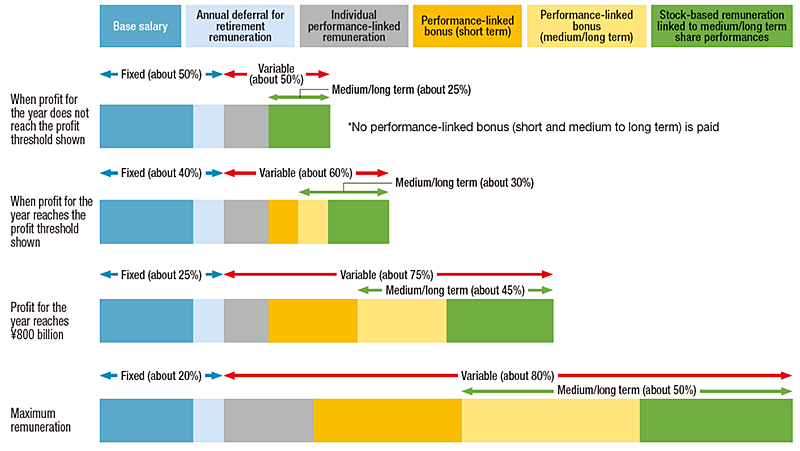

The total remuneration amount (actual payment amount) and individual payment amounts for Directors, excluding individual performance-linked remuneration, are determined by a resolution of the Board of Directors within the upper limits for each type of remuneration decided by resolution of the Ordinary General Meeting of Shareholders held on June 21, 2019. Base salary and annual deferral for retirement remuneration, forms of fixed remuneration, are paid in amounts determined by the Board of Directors. As for variable remuneration, payments of performance-linked bonuses (short term), performance-linked bonuses (medium to long term) and stock-based remuneration linked to medium- to long-term share performance are determined, while reflecting key performance indicators, based on a formula set by the Board of Directors following deliberation by the Governance, Nomination & Compensation Committee.

MC has adopted a clawback policy*In the event that an executive officer causes any loss or damage to the company from willful misconduct or negligence, a serious violation of a delegation agreement, or a serious accounting error/ex-post revision of a financial report due to misconduct resolved by the Board of Directors, non-payment or reduction of the amount/reclaiming of the paid amount is possible by resolution of the Board of Directors. The Governance, Nomination & Compensation Committee continuously deliberates and monitors the appropriateness of remuneration compositions, including remuneration items which are subject to the clawback policy.*, applicable to the individual performance-linked remuneration, performance-linked bonuses (short term) and performance-linked bonuses (medium to long term) of Executive Directors, revising the regulations for executive officers by resolution at the Board of Directors’ meeting held on February 18, 2022.

The payment amounts of individual performance-linked remuneration paid to Directors based on their individual performance assessment, including a qualitative assessment, are determined and paid on an individual basis, reflecting the President’s yearly performance assessment in both financial and non-financial terms of each Director for the relevant fiscal year (the Board of Directors delegates authority to the President for deciding the individual payment amounts). Performance evaluations of Executive Directors comprehensively take into account their contributions to the organizations and businesses they oversee; their contributions to the management of the entire Company, Corporate Staff Section, Business Groups and offices; and the state of the initiatives for value creation that leads to sustainability.

The annual assessment on the President’s performance is decided by the President’s Performance Evaluation Committee, which is delegated this authority by the Board of Directors (and is a subcommittee of the Governance, Nomination & Compensation Committee). The subcommittee is comprised of the Chairman of the Board, who also serves as the chair of the Governance, Nomination & Compensation Committee, and Independent Directors sitting on the committee.

Results of the performance assessment are reported to the Board of Directors and the Governance, Nomination & Compensation Committee to ensure objectivity, fairness, and transparency.

Based on the policy for determining remuneration packages (including methods for calculating performance-linked bonuses) that was approved at the ordinary meeting of the Board of Directors held on May 17, 2019, and the extraordinary meeting of the Board of Directors held on June 21, 2019, each year, the Governance, Nomination & Compensation Committee deliberates and the Board of Directors makes a resolution determining that the total amount of director remuneration packages and methods for deciding payments to individual directors are consistent with said policy for determining remuneration packages.

Each year the Governance, Nomination & Compensation Committee deliberates and monitors the fairness of the remuneration levels and compositions (including remuneration items which are subject to the clawback policy) as well as the operational status of remuneration systems. This is done with the reference to data on remuneration levels and composition ratios provided by an external consulting firm (Willis Towers Watson).

To ensure the independence of the Chairman of the Board and Independent Directors, who undertake functions of management oversight, and Audit & Supervisory Board Members, who undertake audits, MC only pays them fixed monthly remuneration.

Total and individual amounts of remuneration paid to Audit & Supervisory Board Members are determined following deliberations by the Audit & Supervisory Board within the scope of remuneration for Audit & Supervisory Board Members approved at the Ordinary General Meeting of Shareholders, held on June 21, 2019.

Note:

1) to 5) in the table indicate the number of limits on remuneration that correspond to each remuneration item.

Remuneration limits for Directors and Audit & Supervisory Board Members are approved at the 2019 Ordinary General Meeting of Shareholders for FY2019 held on June 21, 2019, as described in 1) to 4) and 5) below.

The number of Directors to whom the above amounts of Director remuneration (excluding stock-based remuneration linked to medium- to long-term share performance) applied was 13 (including 5 Independent Directors); the number of directors to whom the above amount of stock-based remuneration linked to medium- to long-term share performance applied was 7; and the number of Audit & Supervisory Board Members to whom the above amount of Audit & Supervisory Board Member remuneration applied was 5 (including 3 Independent members).

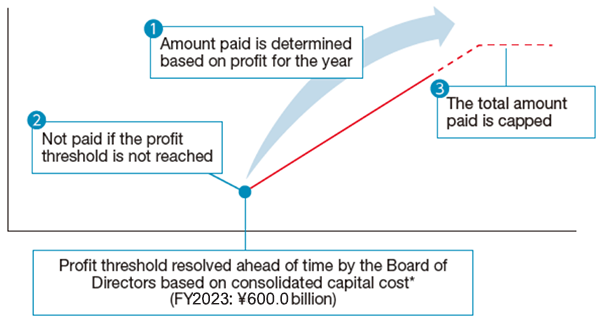

Details of the calculation formulas are as follows.

The upper limit will be the lower of i) ¥648 million or ii) the maximum total of individual payment amounts prescribed in (2) below.

The specific calculation formula for each position is as follows (rounded to the nearest ¥1,000). However, the payment amount will be ¥0 if the profit falls below the profit threshold resolved ahead of time by the Board of Directors based on the consolidated capital cost (¥600billion).

President and CEO:

(profit in FY2023 – ¥520 billion) × 0.025% + 0.35 (¥100 million)

Senior Executive Vice President:

(profit in FY2023 – ¥520 billion) × 0.01% + 0.14 (¥100 million)

Executive Vice President:

(profit in FY2023 – ¥520 billion) × 0.0075% + 0.105 (¥100 million)

Given the composition of Directors as of June 23, 2023, the maximum payment amount and its total for each position as Executive Officers of eligible Executive Directors are as follows.

| Position | Maximum payment amount | Number of persons | Total |

|---|---|---|---|

| President and CEO | ¥175 million | 1 | ¥175 million |

| Senior Executive Vice President | ¥70 million | 1 | ¥70 million |

| Executive Vice President | ¥52.5 million | 2 | ¥105 million |

| Total | 4 | ¥350 million | |

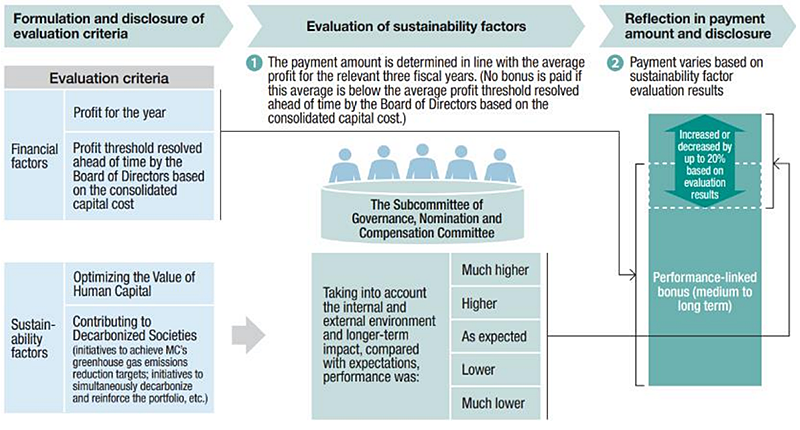

The payment amount will be calculated as follows.

(Payment amount replacing the above performance-linked bonus (short term) calculation formula with the formula prescribed below) × (Results of evaluations initiatives related to sustainability factors*Sustainablity factors over three fiscal years of the performance period in both quantative and qualitative terms evaluated at a newly established subcommittee of the Governance, Nomination & Compensation Committee (the members of the subcommittee are the Chairman of the Board and Independent Directors, to whom this form of remuneration does not apply, and the committee is chaired by an Independent Director.)*) [80%~120%]

The upper limit will be the lower of i) ¥648 million or ii) the maximum total of individual payment amounts prescribed below.

Given the composition of Directors as of June 23, 2023, the maximum payment amount and its total for each position as Executive Officers of eligible Executive Directors are as follows.

| Position | Maximum payment amount | Number of persons | Total |

|---|---|---|---|

| President and CEO | ¥210 million | 1 | ¥210 million |

| Senior Executive Vice President | ¥84 million | 1 | ¥84 million |

| Executive Vice President | ¥63 million | 2 | ¥126 million |

| Total | 4 | ¥420 million | |

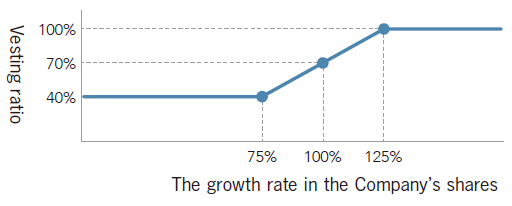

Market conditions

・Initial number of allocated stock acquisition rights for the position (based on position as of April 1, 2023) × vesting ratio

・Growth rate of at least 125% in MC’s shares: 100%

・Growth rate between 75% and 125% in MC’s shares: 40% + (MC’s shares growth rate [%] – 75 [%]) × 1.2 (amounts less than 1% rounded to the nearest whole number)

・Growth rate less than 75% in MC’s shares: 40%

Growth rate in MC’s shares = MC’s TSR (three years)/TOPIX growth rate (three years)

MC’s TSR = (A + B)/C

TOPIX growth rate = D/E

Note: The proportions shown above are based on certain values for consolidated earnings and the share price, and are for illustrative purposes only. The actual mix will vary depending on changes in Mitsubishi Corporation’s consolidated financial results and stock market conditions.

MC sets the guideline for share ownership. The basic policy of the guideline is that Executive Directors and Executive Officers are obliged to hold any shares including those acquired through the exercise of stock options while in office. Sales of such shares are restricted until their aggregate market value exceeds approximately 300% (500% for President and CEO) of the base salary.

MC resolved to revise the remuneration package for Executive Directors after continual deliberations by the Board of Directors and the Governance, Nomination and Compensation Committee. The specific review process is as follows.

Total remuneration amounts for Directors and Audit & Supervisory Board Members and numbers of eligible people are as follows.

| Title | Total Remuneration | Base salary | Annual deferral for retirement remuneration | Individual performance bonus | Performance-linked bonus (short term) | Performance-linked bonus (medium to long term) | Stock-based remuneration linked to medium- to long-term share performances | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | ||

| In-house Directors | 1,805 | 9 | 554 | 5 | 61 | 5 | 220 | 5 | 385 | 5 | 385 | 5 | 199 |

| Independent Directors | 150 | 6 | 150 | - | - | - | - | - | - | - | - | - | - |

| Title | Total Remuneration |

Base salary | Annual deferral for retirement remuneration | Individual performance bonus | Performance-linked bonus (short term) | Performance-linked bonus (medium to long term) | Stock-based remuneration linked to medium- to long-term share performances | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | Eligible Persons | Total | ||

| In-house Audit & Supervisory Board Members | 174 | 3 | 174 | - | - | - | - | - | - | - | - | - | - |

| Independent Audit & Supervisory Board Members | 63 | 4 | 63 | - | - | - | - | - | - | - | - | - | - |

Remuneration amounts for Directors and Audit & Supervisory Board Members whose total remuneration was ¥100 million or more are shown in the table below.

| Name | Title | Total consolidated remuneration (Millions of yen) |

Amount by Type of Remuneration (Millions of yen) | |||||

|---|---|---|---|---|---|---|---|---|

| Base salary |

Annual deferral for retirement remuneration*1The amount of annual deferral for retirement remuneration is accumulated each year as a fixed amount of remuneration for the exercise of duties by each Director over one year. It is paid to the Director after his or her retirement.*1 | Individual performance bonus | Performance-linked bonus (short term) | Performance-linked bonus (medium to long term)*2The amount of Performance-linked Bonus (Medium to long-term) are paid on an average of the consolidated net income for FY2022 to FY2024, but as this cannot be decided currently, the amount shown is provisions for such bonuses as of FY2022, and differs from the actual paid amount.The actual amount paid for FY2022 will be based on a formula confirmed in advance by the Governance, Nomination and Compensation Committee and resolved by the Board of Directors, and the amount for the fiscal year for FY2022 will be disclosed in FY2024 Business Report.The actual amount paid for FY2020 was based on a formula confirmed in advance by the Governance, Nomination and Compensation Committee and resolved by the Board of Directors. The amount was paid on the average of 763.6 billion yen in profit for FY2020 to FY2022, 115 million yen to President & CEO (Mr Takehiko Kakiuchi) and 34 million yen respectively to 4 Executive Vice Presidents (Mr Kazuyuki Masu, Shinya Yoshida, Akira Murakoshi, and Masakazu Sakakida) in FY2020. The actual amout paid for FY2021 will be paid on an average of the profit for the fiscal years ended March 31, 2022 to 2024, but as this cannot be decided currently, 175 million yen to President & CEO (Mr Takehiko Kakiuchi) and 52 million yen respectively to 4 Executive Vice Presidents (Mr Kazuyuki Masu, Akira Murakoshi, Yasuteru Hirai and Yutaka Kashiwagi) in FY2022 but was not included in the table. The actual amount paid for FY2021 will be disclosed in FY2023 Business Report.*2 | Stock-based remuneration linked to medium- to long-term share performances*3The amount of Stock-Based Remuneration linked to Medium- and Long-term Share Performances is the amount recorded as an expense in the accounting treatment for that fiscal year and differs from the actual amount received from the exercise or sale of stock options. In regard to Stock-Based Remuneration linked to Medium- and Long-term Share Performances, the number of exercisable shares will be determined according to the growth rate in MC's shares over three years from being granted, based on a formula confirmed in advance by the Governance, Nomination and Compensation Committee and resolved by the Board of Directors. Under the conditions for exercise of stock acquisition rights, the starting date of the exercise period for stock acquisition rights had not arrived as of March 2023.*3 | |||

| Takehiko Kakiuchi | Director | 263 | 263 | 0 | 0 | 0 | 0 | 0 |

| Katsuya Nakanishi | Director | 655 | 91 | 27 | 105 | 175 | 175 | 81 |

| Norikazu Tanaka | Director | 203 | 32 | 7 | 34 | 52 | 52 | 25 |

| Yasuteru Hirai | Director | 218 | 42 | 9 | 27 | 52 | 52 | 33 |

| Yutaka Kashiwagi | Director | 221 | 43 | 9 | 30 | 52 | 52 | 33 |

| Yuzo Nouchi | Director | 199 | 32 | 7 | 30 | 52 | 52 | 25 |

None of MC’s Directors and Audit & Supervisory Board Members serve concurrently as employees.

MC has a performance-linked bonus system for non-executive employees, including some fixed-term contract employees.