MC has a basic policy of identifying various risks involved with its business activities, classifying them by their characteristics, and managing them in order to maintain and improve its financial soundness and corporate value. In particular, risks that significantly affect MC’s financial position and social standing are identified and managed on a consolidated basis.

MC maintains the following Risk Management System under the aforementioned policy.

| Risk Type | Director in Charge | Duties Overseen |

|---|---|---|

| Credit risk, market risk, business investment risk, country risk | Yuzo Nouchi | Corporate Functional Officer, CFO |

| Information management risk, legal risk, compliance risk, employee safety risks such as natural disasters/terrorism/emerging infectious diseases, etc, business continuity risk | Yutaka Kashiwagi | Corporate Functional Officer, Human Resources, Global Planning & Coordination, IT |

| Environmental risk | Kenji Kobayashi | Corporate Functional Officer, CSEO |

| Supervising Organization | Matters for Supervision |

|---|---|

| Business Investment Management Department | Business Investment risk and market risk (Investment Return Valuation System, new business investments, actions for existing business investees, transactions by business investees, granting loans/guaranty, acquisition and disposal of fixed assets, mikoshi, acquisition and disposal of non-affiliated investments, etc.) |

| Sustainability Department | Climate risk, etc. |

| Corporate Administration Department (Security & Crisis Management Office) |

Risk of natural disasters, etc. (risks related to employee safety, including natural disasters, terrorism, new infectious diseases, and business continuity risks) |

| Legal Department | Compliance risk (litigation/government investigations, laws and regulations, scandals/ compliance issues) |

| Finance Department | Credit risk, Market risk (foreign exchange, interest rate, stock price,foreign exchange mikoshi*The Structured Finance, M&A Advisory Dept. also manages foreign exchange mikoshi.*, etc.) , Country risk |

| Mitsubishi Corporation Financial & Management Services (Japan) Ltd. | Credit risk (rating systems, conclusion of contracts, trade credits, bailment, payment extension, etc.) |

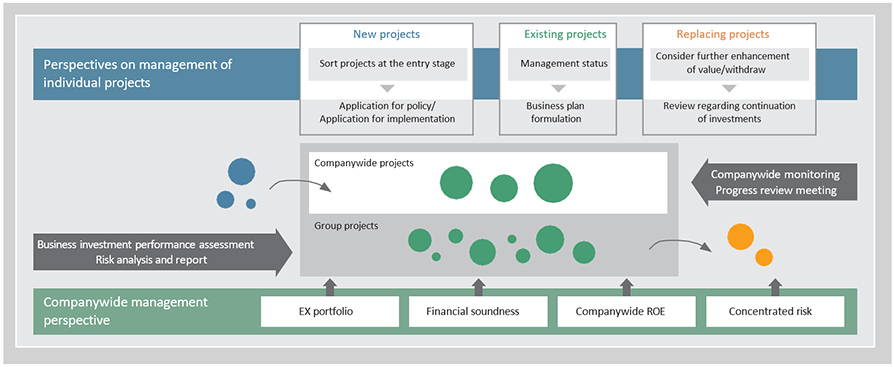

To manage business investment risk properly, MC has established a screening process to review and make decisions on new, existing, re-profiling and each other type of projects.

| New projects | Application for policy/Application for implementation | Narrow down new investment and finance proposals by comprehensively evaluating quantitative aspects in terms of the invested capital and its return determined on the basis of the characteristics of each business, in addition to evaluation of qualitative aspects, including consistency with the business strategy of each Business Group, as well as risk locations and countermeasures |

|---|---|---|

| Existing projects | Business plan formulation | Once a year, review subsidiaries and affiliates’ management issues and initiatives as well as MC’s functions and business life cycle |

| Replacement projects | Review regarding continuation of investments | Conduct qualitative and quantitative evaluations of new investment and finance proposals based on the priority order of Business Group strategies and promote a healthy business metabolism |

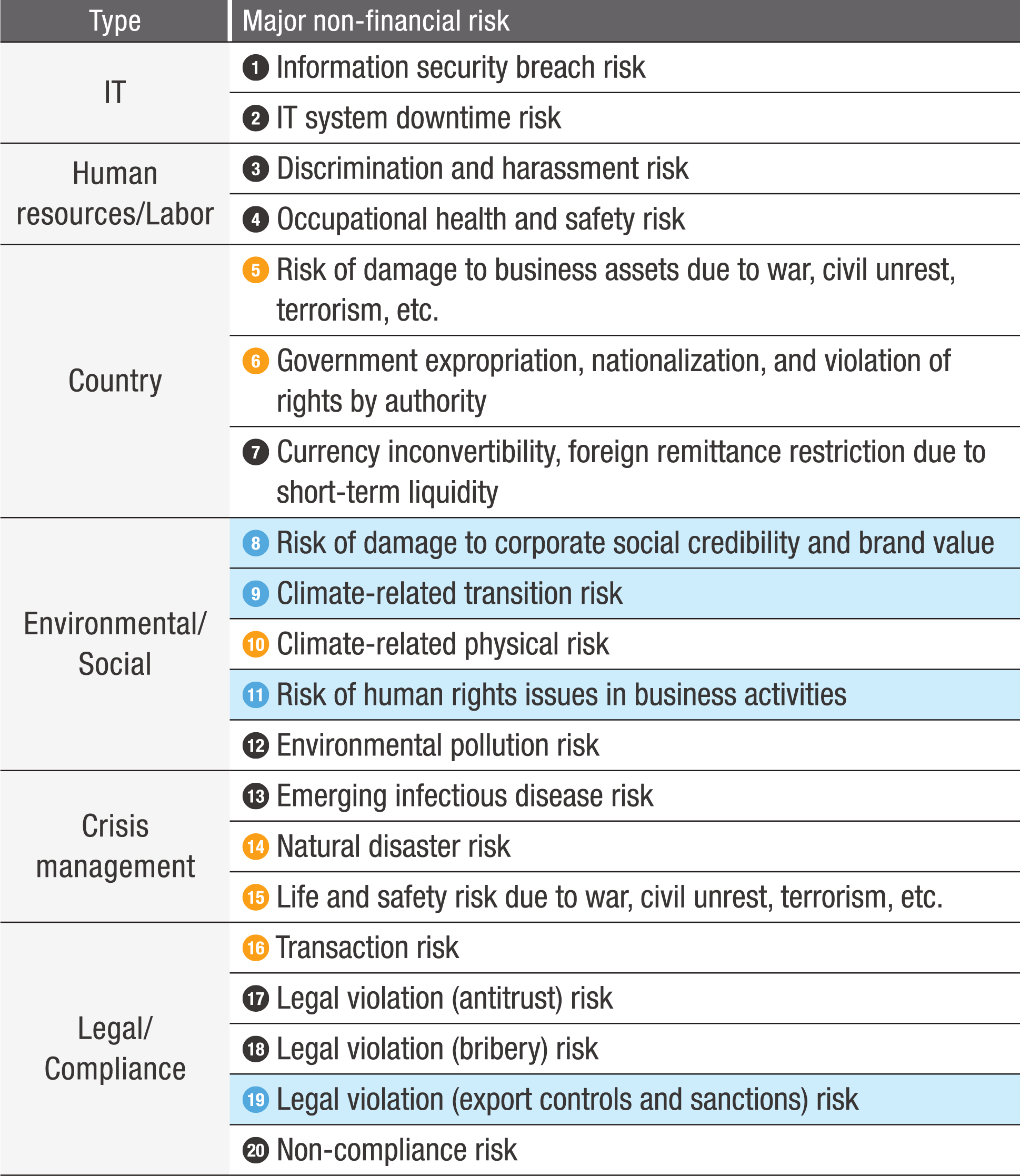

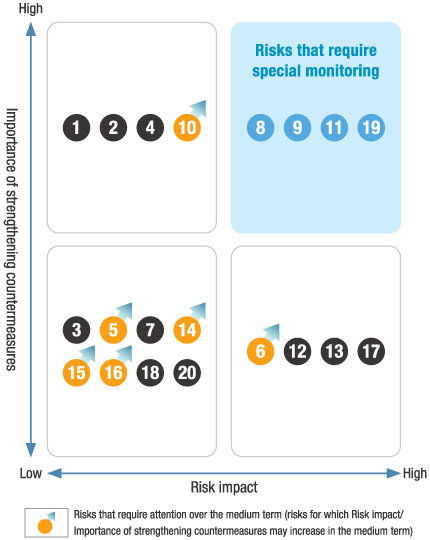

MC implements integrated risk management and monitoring in addition to responding to risks individually. As an example, we identify operational risks, which have become increasingly important in recent years. Every year, we report our evaluation of these risks to the Board of Directors, which is based on unified standards, as well as on the establishment and operation of risk management systems, taking into account future changes in the external environment. In the fiscal year ended March 31, 2024, we conducted the following three-step evaluation and reported the results to the Board of Directors.

⑤ Risk of damage to business assets due to war, civil unrest, terrorism, etc.

⑥ Government expropriation, nationalization, and violation of rights by authority

Responding to geopolitical uncertainties, we conducted the Global Intelligence Committee based on information gathered from the global network. In addition, we have developed a country risk countermeasure system on a company-wide basis to cope with the deterioration of national financial discipline, particularly in emerging countries.

⑩ Climate-related physical risk

For the two assets (metallurgical coal and copper) determined to have a high level of exposure to physical risks in the physical risk assessment (metallurgical coal and copper; see the Climate Change section for additional details), we check annually whether there are any updates to the current measures and future adaptation strategies already disclosed.

⑭ Natural disaster risk

We have prepared initial response and BCP on a consolidated basis both in Japan and overseas*.

⑮ Life and safety risk due to war, civil unrest, terrorism, etc.

We have built up a structure for securing the lives and safety of our employees on a consolidated basis both in Japan and overseas*.

⑯ Transaction risk

We are preventing negative impacts come from the transaction risk by clarifying the contractual relationship and to mitigate the loss with the support of the legal department when we expose to the risk.

|

⑤ Risks of damage to business assets due to war, civil unrest, terrorism, etc. |

|---|---|

Based on the various risk factors of each country, we set ceilings of acceptable risk (Company-wide Management Framework) for each country and conducts a semi-annual survey to control the accumulation of risk. |

|

|

⑨ Climate-related transition risk |

We have already set GHG emissions reduction targets and have disclosed Scope 1, 2, and Scope 3 Category 11 emissions as well as avoided emissions (See Key GHG Metrics and Disclosure Highlights for additional details). Based on these initiatives, in order to comply with sustainability disclosure standards, we are continuously considering and reviewing internally how best to quantify the financial impact of climate-related transition risk and the appropriate disclosure methods. |

|

|

⑬ Emerging infectious disease risk |

|

We are focused on building a system to mitigate loss in the event of a risk appeared. |

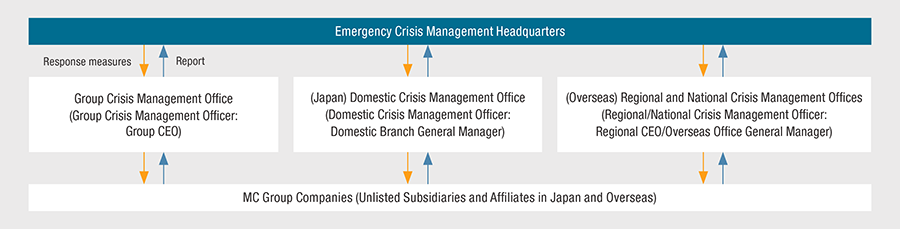

MC has built up a structure for securing the lives and safety of employees and their families as we respond on a consolidated basis to all crises that impact our profit and business continuity (all-hazard approach) by linking together each Group/Regional and National Crisis Management Offices under the management and supervision of the Emergency Crisis Management Officer (Representative Director and Executive Vice President Yoshiyuki Nojima).

Based on the all-hazard approach, MC has built up an internal structure that anticipates all kinds of risks, such as major natural disasters, acts of terrorism, riots, emerging infectious diseases, supply chain disruptions, legal transgressions, and cyber incidents, and etc. Under usual conditions, in cooperation with the organizations in charge (related corporate staff departments and Business Groups), we build and establish various crisis management measures and structures needed in the event that a crisis does occur, so that we can ensure the safety and ascertain the status of all concerned as part of our initial response, and then act promptly to maintain and recover the infrastructure necessary for business continuity.

In particular, for a serious incident impacting the lives and safety of our employees, as well as continuity of critical business operations, we have a structure in place in which we will respond under the companywide direction of the Emergency Crisis Management Officer, in accordance with our Business Continuity Management (BCM) process on a consolidated basis.

Even in normal times, MC makes necessary preparations in anticipation of natural disasters, acts of terrorism, riots, labor disputes, accidents and any other crises in Japan or overseas that could affect the safety of our employees or the continuity of our earnings, assets and businesses.

Specifically, in addition to our various frameworks, regulations, manuals and systems, we conduct a number of initiatives to increase their effectiveness. As well as organizing earthquake simulation training at the Emergency Crisis Management Headquarters and safety confirmation drills on a consolidated basis, we have also established training on crisis management and safety measures for employees assigned to new posts in order to raise employee awareness.

(Examples of main crisis management initiatives)

| Internal Rules and Regulations | BCP / Manual | Other Specific Measures | In-House Education and Training, etc. | |

|---|---|---|---|---|

| Common |

|

|||

| Japan |

|

|

|

|

| Overseas |

|

|

|

|

| Emerging infectious diseases |

|

|

|

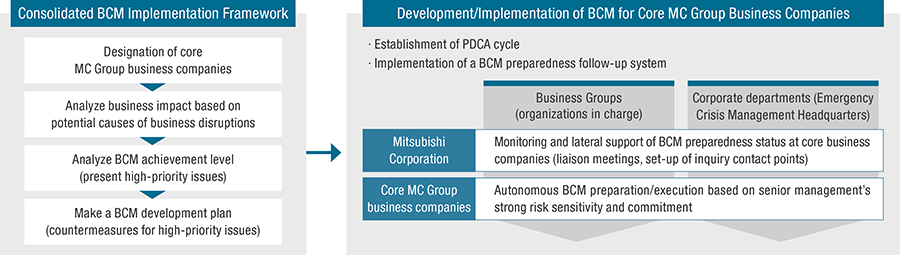

In FY2018, MC adopted “Business Continuity Management (BCM)” for its core business companies (selected from among MC Group companies) to establish and strengthen our consolidated framework designed to equip us with the business continuity capabilities needed to respond appropriately to major crisis situations.

BCM refers to comprehensive management activities based on an all-hazard risk and impact analysis that takes into account the business characteristics (business type and location) of the operating company, which include the formulation of initial response and BCP, establishment of a structure, and implementation of an ongoing PDCA cycle through education and training.

We conduct analyses of the “cause incidents” that disrupt core operations and trigger “result incidents,” while taking into consideration the characteristics of operations at each company.

Based on the premise that MC Group companies should develop their own BCM systems, we also provide lateral support by developing BCM development tools, such as BCM guidebooks and BCP samples, and by holding BCM Re-examination / BCM Dialogue.

| Internal Rules and Regulations | Guidelines | Lateral BCM Development Support for MC Group Companies |

|---|---|---|

|

|

|

With regard to the above-mentioned crisis management and BCM initiatives, we are working to improve our crisis management and business continuity capabilities by monitoring and providing various types of feedback, including implementation status at Group companies, using the business plans and other documents from each company (unlisted subsidiaries).

In the event of a Tokyo Inland Earthquake, MC has established, based on a certain damage scenario derived from data published by the government and local authorities, a system that enables the launch of an Emergency Crisis Management Headquarters (including remote response), safety confirmation of officers and employees / facility damage at MC Group companies on a consolidated basis. Various stockpiles have also been arranged. In addition, we are preparing for a Tokyo Inland Earthquake by drafting and updating BCPs and manuals in each organization, conducting earthquake simulations and other trainings on a regular basis, and reviewing areas for improvement. In addition, through the promotion of BCM on a consolidated basis, we are working to continuously strengthen the business continuity capabilities of each company.

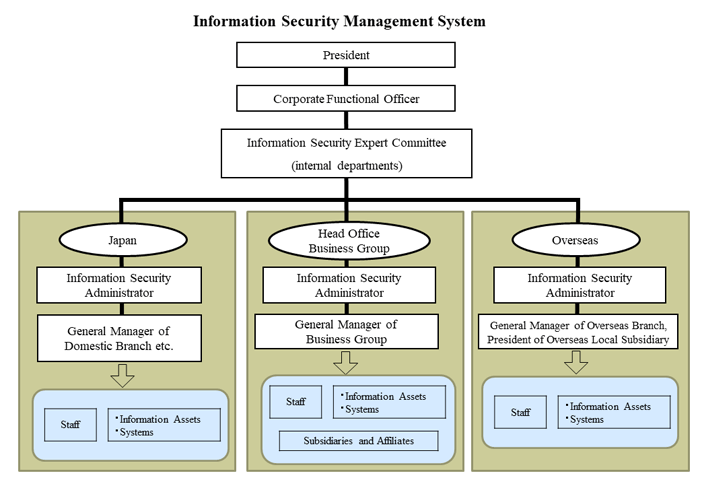

In order to maintain and improve the information security of our company including our major subsidiaries, we have established an internal system, developed relevant regulations for the safe and appropriate handling and management of information assets, and conduct employee training. Furthermore, in order to address cyber-attacks and e-mail frauds aimed at theft and destruction of information, we have implemented appropriate and effective countermeasures, which are not only control measures for information systems but also employee training and checking / implementation of incident response systems including those of major subsidiaries as well as obtaining the latest information in cooperation with specialized external organizations.

The MC Audit & Supervisory Committee deliberates on appointments, dismissals, reappointments and non-reappointments of MC’s Independent Auditors, and each year assesses appropriateness of the audit methods and the audit results. If the Audit & Supervisory Committee deems it fit to dismiss or to not reappoint Independent Auditors, a proposal for new Independent Auditors shall be submitted to the General Meeting of Shareholders.